We were approached by a client with a request to develop a mobile application for their own subsidiary, a neobank entering the MESA market.

Our task was:

- Explore the main user stories and pain points of mobile banking in the MESA market.

- Integrate advanced user experience from world market leaders into the product

- Develop a concept and launch an MVP application in a short time – 8 months

- Develop a roadmap to turn the application into a super-app.

The client has a traditional banking business for the market and a functioning banking infrastructure. As part of the business development strategy, the client had the following goals:

- Launch a new generation financial service – neobank under the new Alpha One brand

- Offer the best user experience to customers and not be inferior to the leaders of the global market

- Attract new customers and increase market share

Table of Contents

Market Research

We conducted a comprehensive study of the client’s target market. MESA countries are characterised by traditional banking services:

- Most services are provided in the office, not through mobile apps

- Limited offer of financial services and products

- Weak customer service

There are also religious restrictions on banking activities and some products and services on the market: interest-bearing deposits and loans are prohibited by religious norms. Instead, banks offer other products:

- Mudaraba is a special type of deposit in which the client deposits money in the bank, and the bank uses it to invest in projects. If the project makes a profit, the bank shares this profit with the client in a predetermined proportion.

- Murabaha is a special type of loan in which the bank buys the good or service that the customer wants to purchase and then sells it to the customer at a price that includes a small markup. The client pays this amount to the bank in instalments.

Together with the client, we have identified the main areas that will distinguish the product from other offers on the markets:

- Remote service. Most services will be provided in a mobile application and will not require a visit to the office.

- Opening accounts for individuals and legal entities in a few clicks.

- Integration of tax instruments. You can pay taxes and duties directly in the application.

- Large selection of co-branded products: co-branded bank cards, loyalty programs and bonus systems.

Solution

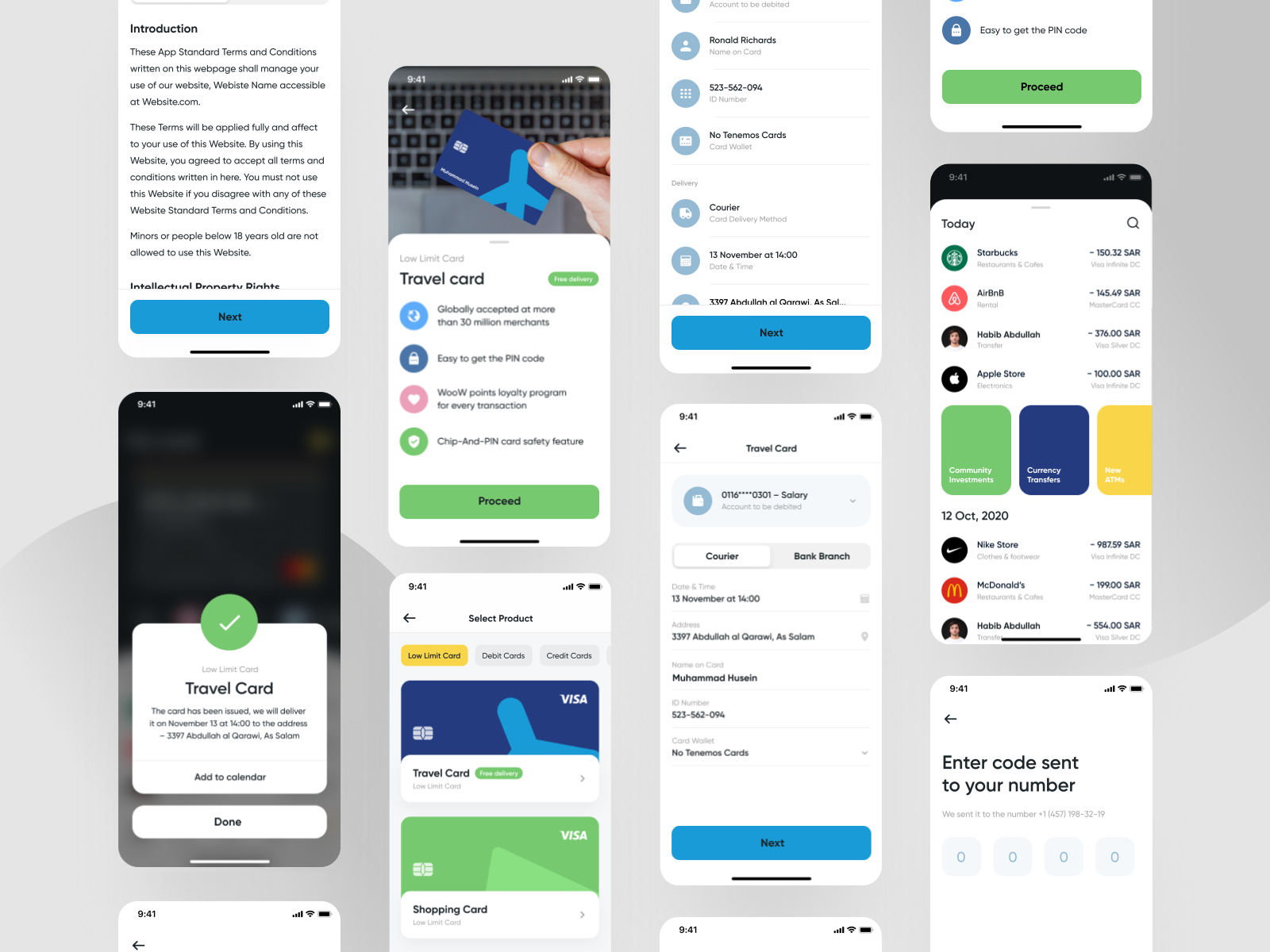

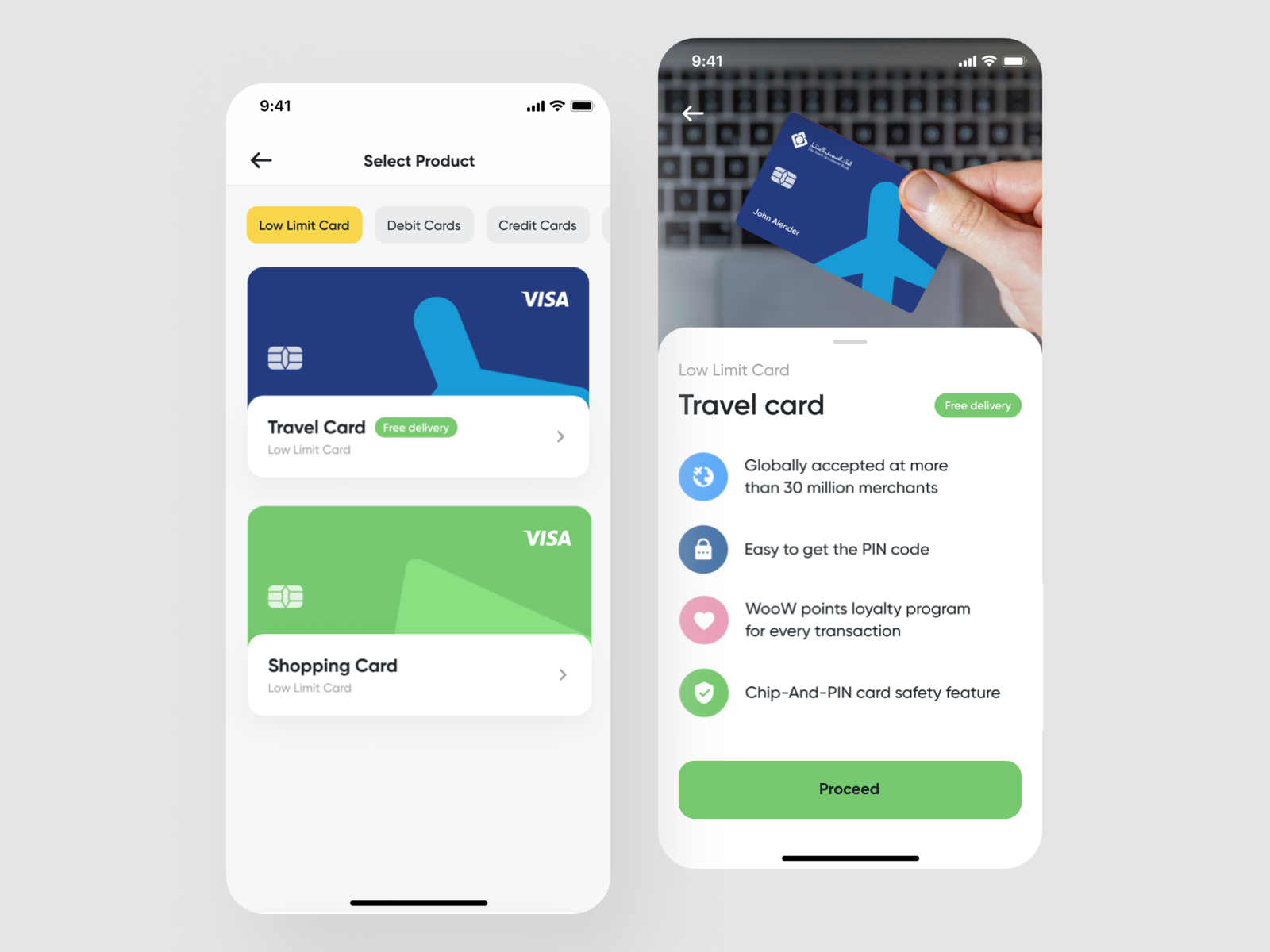

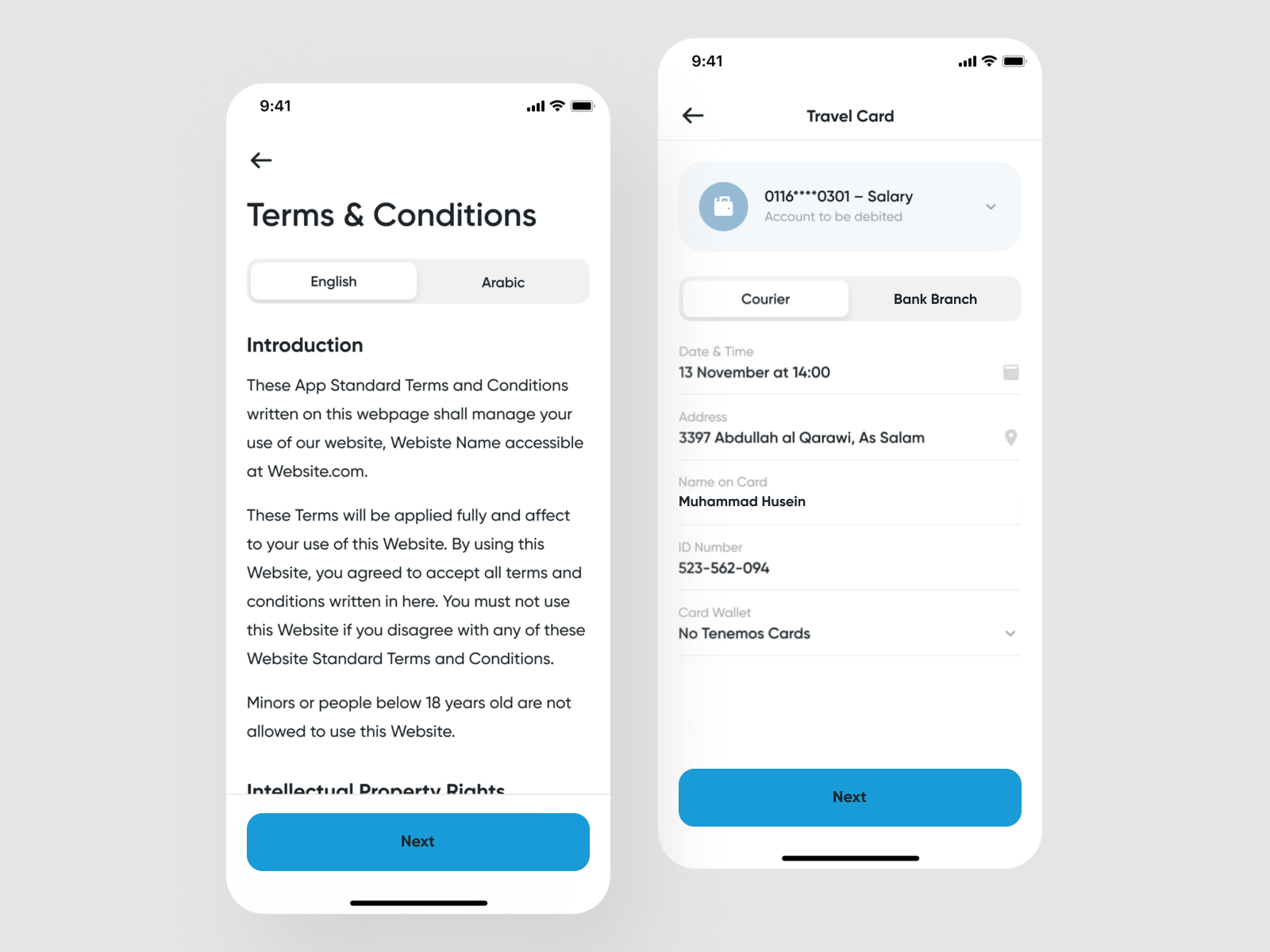

Our team has taken the best user experience and developed an advanced interface for the mobile app.

Application Screens

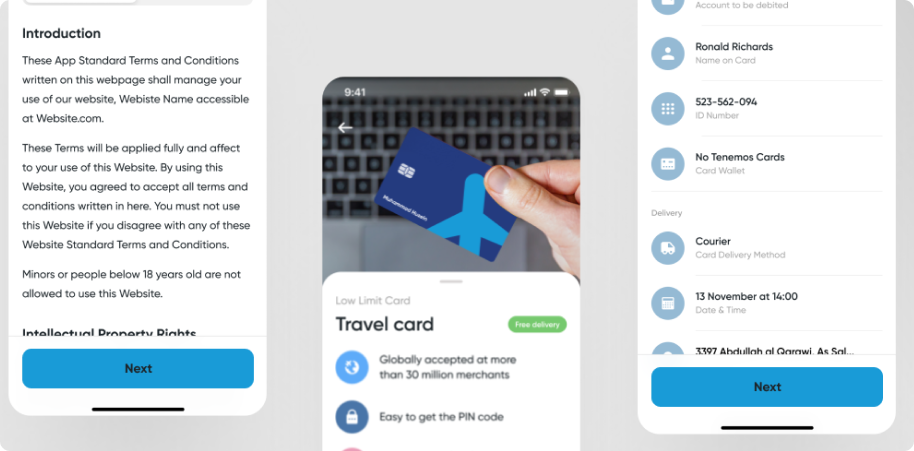

You can issue and order the delivery of a card in just a few clicks using the application.

Technologies used

For Alpha One, we have developed native applications in Swift and Kotlin. For all applications, we use an industry standard architecture with some additional elements. Therefore, we know how it works in different business scenarios and how to write code to simplify autotesting. All this significantly speeds up development and makes the product safe, which is very important for a banking application.

Also, a banking application requires high performance and data transfer rate server-client. To solve these problems, we used a combination of gRPC, HTTP / 2, and Protobuf (Protocol Buffers).

Project timeline

The app development took 8 months. Within the specified time frame, we:

- Conducted market research

- Developed a concept

- Developed UX\UI

- Launched a MVP with functionality:

- Account management and transactions with minimal fees

- Opening accounts for individuals, entrepreneurs and lawyers with a minimum of formalities in 1 hour.

- Co-branded products and loyalty programs

- Tax Instruments

- Map of branches and ATMs

- Technical support

- We launched the application on IOS and Android and put it in the stores

- Successfully achieved the set goals within the time frame